child tax credit calculator

The Child Tax Credit will begin to be reduced below 2000 per child if an individual reports an income of 200000. For tax year 2021 the Child Tax.

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

To calculate your child tax credit determine your income and then find your tax bracket on the IRS website.

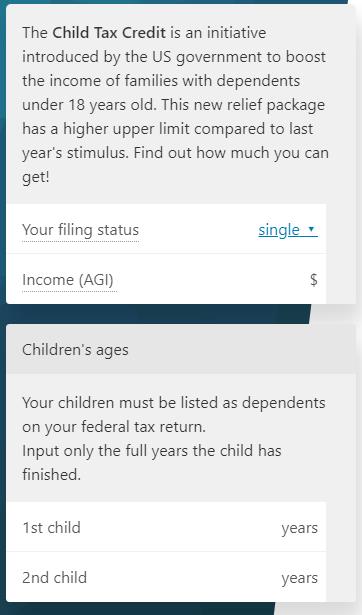

. 2021 Child Tax Credit Calculator Estimate Your 2021 Child Tax Credit Advance Payments The IRS is no longer issuing these advance payments. The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. The child tax credit calculator tells you how much money you might receive in advance monthly payments in 2021 and how much of the credit youll claim when you file your return next year.

You may be able to claim the credit even if you dont normally file a tax return. The child tax credit 2021 income limit has been increased to 3000 per child ages 6 to 17 and 3600 per child under 6. Child and family benefits calculator The payments for the CCB young child supplement are not reflected in this calculation.

The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6. For married couples and joint filers the credit will dip below. Making a new claim for Child Tax Credit already claiming Child Tax Credit Child Tax.

For instance if you are filing for a single return and your annual income is 77000. The full credit is refundable as. Tax credits calculator You can no longer make a new claim for tax credits.

You can use this calculator to see what child and family. If you already get tax credits You can still make a claim. Claim the Child Tax Credit in 2022 by e-filing.

Child Tax Credit Calculator. In 2022 US expats are eligible to receive between 1400 up to 3600 per qualifying child on their 2021 US Tax Return. Heres what you should know.

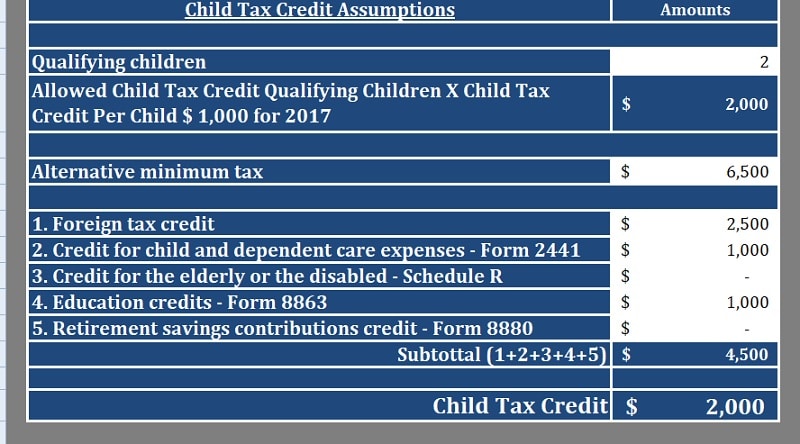

Once you know your tax bracket multiply the appropriate percentage by 1000 per. It not only increases the tax credit for families to 3000 per child between 6-17 years old at the end of 2021 and 3600 per child under 6 years old it also allows half to be paid to families in. According to the IRS.

The increased child tax credit is reduced by 50 for every 1000 income above the thresholds. Our child tax credit calculator will help you estimate your refundable child. Child Tax Credit The Child Tax Credit helps families with qualifying children get a tax break.

You may be able to claim Universal Credit instead. To use it enter your income and dependents information into the calculator and youll receive an estimate of what kind of tax break your family is eligible for this year. What youll get The amount you can get depends on how many children youve got and whether youre.

What Are Marriage Penalties And Bonuses Tax Policy Center

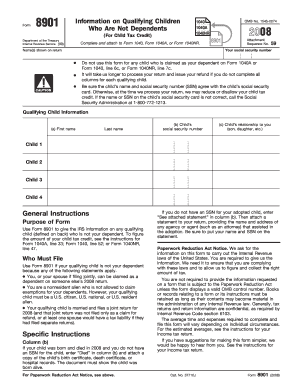

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Child Tax Credit Calculator Ioogo

Omni Calculator Child Tax Credit Lifetime Asset Management

15 Printable Child Tax Credit Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Grandparents And Other Relatives With Eligible Dependents Can Qualify For 2021 Child Tax Credit L Observateur L Observateur

2021 Child Tax Credit Calculator How Much Could You Receive South Central Illinois News Sports And Weather Station

Us Child Tax Credit Calculator Expat Tax Online

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Child Tax Credit Calculator First Source Federal Credit Union

Tax Credits Vs Tax Deductions Nerdwallet

Child Tax Credit Calculator 2021 How Much Moneylion

Download Child Tax Credit Calculator Excel Template Exceldatapro

Tax Credit Definition How To Claim It

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service